Types of Funding

In financeThese are the slides and write up from my 2015 Develop Conference talk, which explored the different types of funding, and examples of each type, that are available to UK developers.

Angels

Angels are ‘High net worth’ Individuals who invest personally, often-small amounts up to £50k, but will sometimes group together to fund larger projects. Some angels will invest more personally.

Who is this for

Startups needing smaller, early stage, sometimes higher risk money.

Tips

Trick is not just finding an angel, but finding one who is interested in what you are doing.

There are angel investor networks all over the UK, but a lot of this is about networking and meeting people in your industry.

Most angels do not advertise themselves.

Friends & Family

This is worth mentioning as a lot of startups end up getting their first seed money from friends and family. That very high risk stage is often really hard for anyone without another motive to invest in – friends and family have that other motive.

VC Funds

Investment Funds come in many shapes and sizes. VC funds focus on earlier stage companies than most, such as private equity funds.

VC funds are all different. They all have different things they focus on, different amounts of money, and different attitudes to risk.

Some examples are London Venture Partners, Mercia Fund management, Index Ventures, M8 Capital and Jenson.

http://www.jensonfundingpartners.com

Who is this for

Some VCs will invest seed funding into startups, others only invest at a slightly later stage, when the company is looking for funding into the millions. You need to be pitching a company that has the chance to make hundreds of millions in revenue – if that is not your goal, then VC funding is not the route for you.

Tips

VCs do focus on the next big thing. Look at what investments other VCs have made recently to get an idea of what the current excitement is about.

Go to VCs who have background in games or entertainment, most others will not understand or be willing to take the risk of our space.

Corporate VC Funds

Similar to other VC funds however they have a strategic as well as financial interest – they are funds setup by large corporations such as Intel’s Intel Capital fund. These funds will invest in things that have a strategic benefit to their corporation.

Who is this for:

This is completely dependent on what you are building, but generally will not be a complete startup as you company would need to have been noticed by the firm, but could be fairly early stage with something revolutionary.

Accelerators

Accelerators do provide more than equity investment, and there are a few that recoup their money in other ways, but generally accelerators take equity in return for a relatively small amount of funding, and a program of support designed to get the company from pre-startup to investment ready.

These programs are usually residential from anything from 2-6 months, and fund anything from £5k to £100k per company.

Some examples are Execution Labs in Canada, Game Founders in Estonia, TechStars and Seedcamp in London and Ignite in Newcastle.

http://www.techstars.com/program/locations/london

Who is this for

Startups who want the support and network that the program provides, plus the cash, so startups without much experience running companies would benefit the most.

Tips

Accelerators can work really well but if you just want money, these are not the route for you.

General Tips on Equity Investment

Equity investors are looking to make more of a return on their money that if they put the money in the bank – that is why they are willing to take the risk. The more risk, the more they want to be able to make back.

Investors are people; find ones who are interested in what you are doing.

Investors will be in your business for a long time. Whilst they are assessing you, you should be assessing them – is this someone you want in your business? Can you see yourself working with them?

Often an investor will want to put someone on the board of directors, be prepared for that level of involvement.

Make sure you know what exit strategy they want, every investor wants to exit at some point – what are their expectations?

They are investing in your business not your game, so your pitch should reflect that.

The UK government has tax benefits for investors who invest in early stage companies. SEIS and EIS are schemes that investors can use to reduce the risk in their money, as they get their investment offset against their taxes, EVEN (and this is the great bit) if they lose the money. SEIS is for investments in startups of under £150k, EIS is larger up to £1m. If you are looking for investment of this kind of level, it is likely that investors will use this to reduce their risk.

Different types of investors have different requirements of what they want to get out. VC funds have to make high returns, whereas smaller funds or individuals, particularly when using tax incentives, may actually be in a very different position and actually not need to make that much of a return to benefit. Knowing what the funds goals are is key. Try finding this out before you even approach them, it will help with pitching, but also with negotiating a better deal for yourself.

Project finance is actually now one of the least prolific sources of funding. There are fewer companies providing this for the industry than other types.

SEIS Funds

Of those that do exist, one of the most popular right now are some of the SEIS funds.

This is where it gets slightly confusing, SEIS is a tax benefit against equity investment but is used effectively as project financing by these funds. They do this by setting up SPVs, which hold the IP that they invest in. The SPV is jointly owned by the fund and the team. They will generally take a fairly high % of the shares in the SPV – between 30-50% is to be expected.

A significant number of games in the UK have received up to £150k funding through this model.

Some examples are Tesseract Fund and Kuju Startups.

http://ramcapital.co.uk/portfolio-item/tesseract-interactive-seis-fund-5

Project financing

Aside from the specific SEIS funds are other project financing organisations.

One of the most high profile is the Indie Fund in the US, but also Standfast in the UK and Vision+ in Finland do project financing, each giving different amounts (indie fund generally smaller from what I understand).

Who are these funds for?

One off games, usually want an experienced team. Most want prototypes, some don’t. The project should fit the size of the funding available.

Tips

Focus on the game when you pitch, keep it simple but have solid forecasts.

Do your research and approach the right company, in terms of how much money you need in particular.

Show you understand how to make money and how to market your game.

They are usually looking to make a quicker return that equity investors, so generally will want 100% of profits until they get their money back plus a certain percentage, then will split it with you.

If you want money but not a long term investor in your business, and are willing to potentially give up a higher percentage of the project you get funded, this is possibly a route for you.

Particularly on smaller funds, it is better if you can match this funding with something else such as a grant, to boost the money.

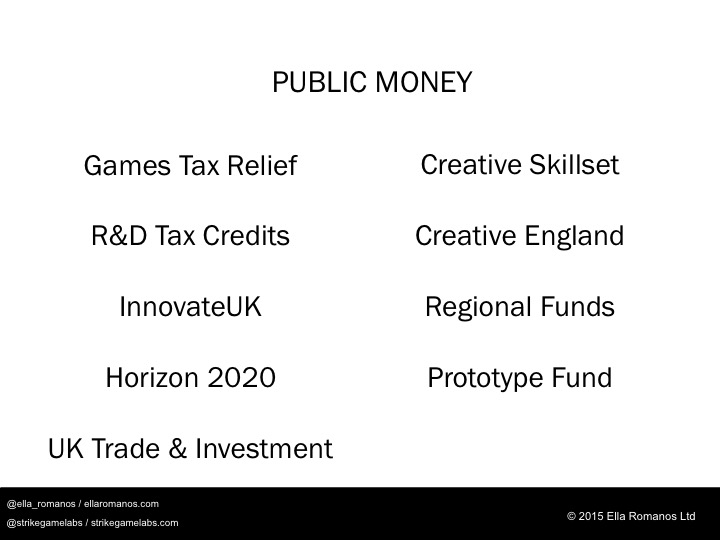

Public Grants can be a minefield, so this just focuses in on some of the more common ones for games.

Games Tax Relief

Introduced last year, gives companies up to 20% of their production costs back.

There are some restrictions, you can only claim back against costs spend in the EU, and you have to pass the ‘cultural test’ which seems to put people off a lot more than it should.

I would strongly suggest that if you aren’t already claiming it, you should be. The cultural test doesn’t take long to go through (I have done it in 30 minutes) and that will tell you if you should qualify.

Claiming is fairly straight forward, and you don’t have to have finished or released your game to claim, most companies claim once a year during development.

http://www.bfi.org.uk/film-industry/british-certification-tax-relief/cultural-test-video-games

R&D Tax Credits

These have been around a long time, and before GTR were used quite a lot.

They still definitely have a use though, as if you are building tech, you can get some of your costs back.

You cannot claim GTR and R&D against the same spend though.

InnovateUK

InnovateUK (Technology Strategy Board), provide grants to companies who are doing things that can be classed as technology innovation.

They do not fund games or content, but if you are developing an algorithm, or a tool, or an engine, along with your game for example, then you may be eligible for up to £250k grant funding.

They have various grants, but often the most useful is SMART grants, which are open brief, for very early stage projects, (often just a concept) and companies can apply for up to 60% match funding for their project up to £250k.

More info here: http://tenshigrants.com/innovateuk-smart-grants

Horizon 2020

Horizon 2020 is an EU grant fund. Similar to InnovateUK it invests in technology innovation, but with larger sums of money, for which it wants more advanced projects.

More info here: http://www.tenshigrants.com/horizon-2020-grants

Creative Skillset

Provide funding for training. One of their most popular schemes is Trainee Finder, where they will cover 50% of a graduate (or new to role) salary.

They also have commissioned funding and funded training schemes, where if you want to go on a training course, they can part fund that for you or for multiple people in a company.

http://creativeskillset.org/who_we_help/creative_businesses/funding_for_creative_businesses

UK Trade & Investment

UKTI is the section of the government that supports export. Our industry is naturally export focused so companies can get various funding. It is small amounts, but for example they can cover part or sometimes most, of the costs of travel, accommodation and exhibiting at overseas events. They can also help with costs for marketing materials for example.

UKTI is run regionally so you need to find who your local representative is and build a relationship with them.

Creative England

Across the UK are multiple screen agencies. These regional organisations were setup originally to support film and TV but have mostly expanded to games and digital as well now. Creative England came out of the southwest screen agency and now covers a larger area including the midlands.

They provide various grants, all matched, for game developers. The benefit is that the grants are for game development, but their goal is job creation and economic growth, so they usually have quite strict requirements for number of people you will take on with the money they provide.

They previously could not fund companies in the South East, due to restrictions of their funding (out of their control) however now they have managed to expand to England except for anyone inside the M25!

http://www.creativeengland.co.uk

Regional Funds

Most regions have specific funds. In particular, Scotland, Wales, Midlands, Birmingham, North East and Yorkshire seem to have pots of money available. I won’t go into them now, check out the post on tenshigrants.com, but most of these funds are also about job creation and/or economic growth.

Prototype Fund

You may remember the Abertay Prototype Fund that was around until a few years ago. This is essentially a new version of that. The fund will be reopening sometime soon.

I am excited about this because it’s the only public money that is:

a) for games specifically

b) isn’t match funded

c) is for total early stage projects, so no prototype needed to apply

£25k available for prototypes and for some companies they may be able to apply for £50k. Total of £4m to spend from 2016-2020.

General tips on public funding

Public funds will generally invest in high risk companies because their remit is not to make money but to help companies grow.

Often the people controlling the funds do not know your market or industry, this can be challenging.

There can be a lot of admin and paperwork. Applying can be complex, as can managing the process once you have it.

There are so many pots of money you could spend all your time just researching and applying.

Do not try to crowbar your project to fit a fund – it isn’t worth it.

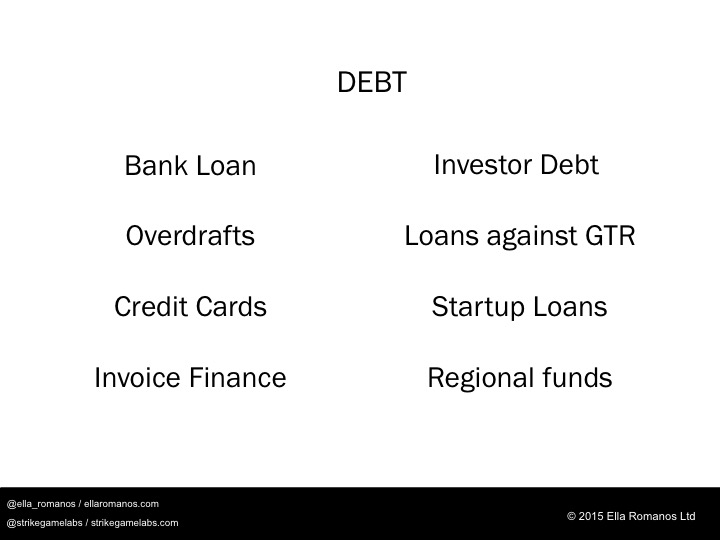

Banks

Banks are often though of when we mention debt, and they do provide various forms, from overdrafts and credit cards, to loans and invoice finance.

Aside from that, though there are a few other options.

Investor debt

Firstly, it is worth mentioning that in many cases, when investors look to take equity, they will often ask for a mix of equity and debt. This can be a good thing, but the balancing is key, so be prepared for this in larger deals in particular.

Loans against VGTR

This is what my company Altara Games does, the model has been around in the film industry for years (against film tax relief) but essentially these loans can help cashflow your business, by providing you the money as soon as you start your project, and taking it back when you claim your GTR a year or more later.

Obviously as you need to spend money to claim GTR this doesn’t replace other forms of funding but does help to enhance your investment into your game, and in particular helps to cashflow your business – which is often a small businesses smallest challenge.

Startup Loans

This is a government scheme, and I have put it in here actually because I do not like this type of funding. The government says it is helping to support startups, yet these loans are to you personally, not to your business, and therefore you are personally liable for paying them back – which defeats the object of limited companies!

On that note, with all types of funding can come various requirements of securities and guarantees. It depends what you are happy to do, but my recommendation is never to accept personal guarantees. Securities against your business are often fine, although the devil is in the detail, but if you are starting a limited company, then do not let people demand personal guarantees from you, and don’t use schemes like this.

Regional funds

As I mentioned under public money, some of the regional funds, including Creative England, provide loans as well as grants. Often interest free or very low interest, these can be a good option, but again usually have requirements such as job creation attached to them. Also do not be deceived, just because they are a public fund does not mean their terms will be soft, make sure to get things checked by a lawyer.

Many developers use, or want to use, work for hire to fund themselves, and then use that to develop their own games.

It is sometimes perceived as an easier route, however there are challenges, in particular making enough profit margin to reinvest in your own games, and balancing resource between client projects and your own projects. Some companies do manage to do this, but it is certainly not an easy route nor will it allow you to move very quickly towards your ultimate goal (unless your goal is to run a WFH studio – in which case that is totally different!).

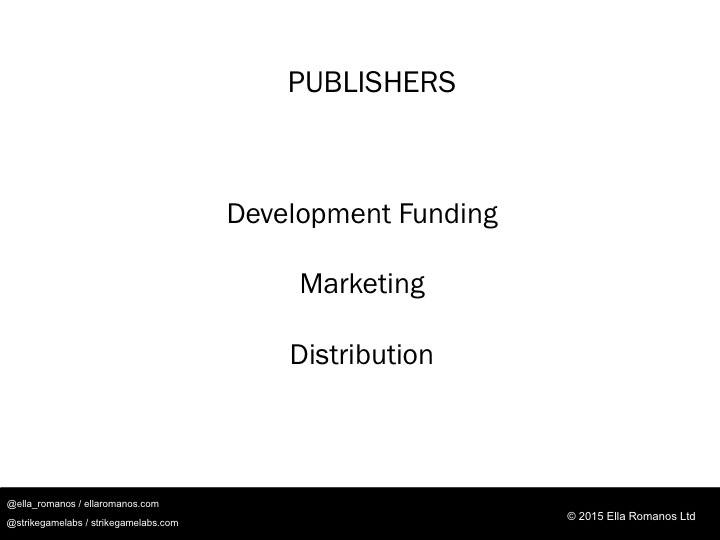

Nowadays, publishers are all different. Many have now adapted to the changing industry, and in fact, we are seeing many new ones who were setup just for the new markets and models that we have.

The simplest way to explain it is that there is now not really a fixed model for how publishers can work with you.

Yes, some still look for the traditional route, but most are at least open to other ideas, in particular ways not to take your IP. Some will now just fund marketing/distribution, taking a rev share but not IP. Some will just do distribution, taking a lower rev share again. Some will part fund, so may help you finish the game, pay for QA or localisation, or maybe will pay for the first 6 months of maintenance on a F2P service game, and again probably won’t ask for your IP for this. Some will fully fund and they may ask for the IP.

Most publishers specialise. There are some focused on indie, some that only deal with much larger projects, some that only do F2P or premium etc.

Find the ones that have a record of accomplishment in similar games to yours.

Tips

Whilst I certainly think publishers are worth considering, I would also put in a word of caution. If a publisher wants a percentage of your game, you need to know what they are going to do for your game. Do not just take their word for it; ask for details on marketing, distribution plans, what money they will invest and so on. It is a two-way relationship and you need to feel that you are getting value for the money you are giving away.

Look at what other games they have published and try to find revenue and sales figures, see what they have done for others.

Speak to others who have worked with them if you can.

Publishers change strategy quite often, so make sure you are up to date.

There are various types of crowdfunding, the most common is project funding but there are others, for example equity funding.

The data shows that crowdfunding has the lowest success rate of all funding methods. Do not think that this is an easy option compared to the others.

If you try to crowdfund and fail, it will make getting other funding harder.

So do not go down this road lightly or without good reason.